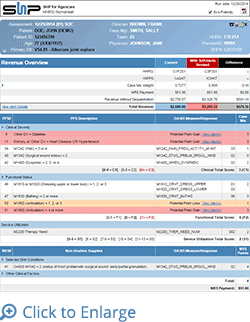

To help Home Health agencies navigate the changing PPS landscape, SHP has released a new version of the popular HHRG Worksheet. This page provides details of each episode in a simple, consumable, and printable format that shows exactly how CMS calculates HHRG, HIPPS, and revenue for each payment episode.

Whenever SHP Alerts have identified potential inconsistencies in an OASIS assessment that may affect revenue, the HHRG Worksheet will highlight each PPS or NRS row that could be affected and how any change would impact the HHRG score and the expected revenue for the episode. This allows you to see each M-item in the OASIS assessment in the context of revenue and shows how documentation and coding errors affect your bottom line.

Some notable enhancements to the new HHRG Worksheet include:

- Integration of all Alert Details features including direct access to Episode Einstein

- PDF export and print support

- Inclusion of primary diagnosis ICD code & description

- Header section can be expanded to show additional episode details including M0030, payment episode start and end dates, and more

- Telehealth indicator

- Line item breakouts for:

- 3% Rural Add On

- 2% Federal Sequestration Deduction

- Any potential gain of case mix points due to data inconsistencies are highlighted in red

- Any potential loss of case mix points due to data inconsistencies are highlighted in orange

- Any case mix change that may affect HHRG scoring brackets are highlighted in red

Download SHP's PPS & NRS Point Scoring Comparison Guide