PDGM will stay the course

Each year I look forward to what CMS has in store for the Home Health (HH) industry when they release the proposed rule for the HH Prospective Payment System Rate Update for the upcoming calendar year. The proposal was posted to the Federal Register on June 30, 2020 and it was one of the shortest on record. The reason? No changes to PDGM are being planned for CY 2021.

It is likely CMS does not have sufficient enough data to recommend any changes with PDGM being just 6 months old. This is good news for most agencies, especially when over the last few months their operations have been mired with the impacts of COVID-19. Although HH agencies have not had much time to fully devote to PDGM, extending the new payment system unchanged for another 12 months, other than a proposed rate increase, will help in their planning and stability.

One of the PDGM changes that was on the table related to the CMS expected behavioral changes. In the CY 2020 final rule, CMS noted proposed adjustments in three areas where they were expecting behavioral changes: 1) Changes in coding related to Clinical Group (-6.40%); 2) Increase in Comorbidity coding with new and additional diagnostic coding (-.25%); and 3) Decreases in LUPA rates (-1.88%). CMS ended up cutting the adjustments by approximately half (-4.36% in total), acknowledging it may take agencies more time before fully implementing behavioral changes due to the scale of the PDGM model changes. The second half of the behavioral adjustments were expected in this ruling, but are now on hold.

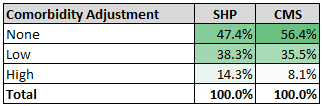

Looking at the SHP National database for the first six months compared to the CMS PDGM model (designed using claims data from CY 2018), there are clearly some behavioral changes that we are beginning to observe. Regarding comorbidity adjustments, the “high” level was modeled to be 8.1% of all 30-day payment periods. The SHP rate is 14.3%, a 6.2 percentage point increase. Even the “low” level category is higher by just under three percentage points (see chart). These higher levels increase the overall case-mix weight of these 30-day periods.

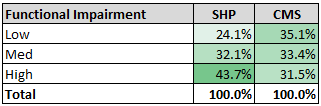

Another PDGM component that has a large impact in higher case-mix weights is the level of Functional Impairment. The ‘high” level is 12.2 percentage points higher than the model. Keep in mind, CMS had designed the point thresholds to achieve about one-third or 33% to be reflected in each level category.

In the case of behavioral changes with the LUPA rate, instead of going down, the rate is actually increasing, the opposite effect CMS was predicting. Where CMS was expecting the rates to go below 7%, the rates are averaging 9.2% for the first five months based on SHP claims data. Clearly, this is due to COVID-19. It will be interesting to watch how these rates will change as the industry recovers from the pandemic.

For other comparisons and LUPA rates broken out by CMS Region, download our pdf: SHP National PDGM Benchmark Data 2020 for additional insights.

In the proposed rule, there was one noticeable absence of another expected regulatory update - Home Health Value Based Purchasing (HHVBP). CY 2020 is the final year of this 5 year Centers for Medicare and Medicaid Innovations (CMMI) demonstration. CMS posted in the Interim Final Rule with Comment that due to COVID “exceptions to the HH QRP reporting requirements, as well as the modified submission deadlines for OASIS data and our exceptions for the New Measures reporting requirements, may impact the calculation of performance under the HHVBP Model for the performance year (PY) 2020."

They also noted “We intend to address any such changes to our [HHVBP] payment methodologies for CY 2022 or public reporting of data in future rulemaking.” In this proposed rule, there was not one mention of HHVBP. The only indirect reference was to the HH QRP - “We are not proposing any changes for the Home Health Quality Reporting Program.” I suspect we should hear something soon since up to 8% of the affected agency reimbursements are tied to their quality performances from this year.

The good news is the PDGM model will stay the same into CY 2021. Given the likely reporting biases of the initial transition to PDGM, I would recommend that you track your data monthly and include the impacts due to COVID-19 as you start your forecasts and budget planning for CY 2021. Even with no changes to the model, the annualization of your PDGM metrics will likely be different from the run rate you will see later in the year.